As consultants specializing in Washington and multi-state taxes, we pride ourselves on deep business knowledge across various industries. It’s our job – and our passion – to keep our eyes on the outcomes of cases across the region so we know exactly how to counsel our clients. We’ll share pertinent cases with you from time to time on our blog and LinkedIn, and we are always available to answer any questions.

What’s Happening

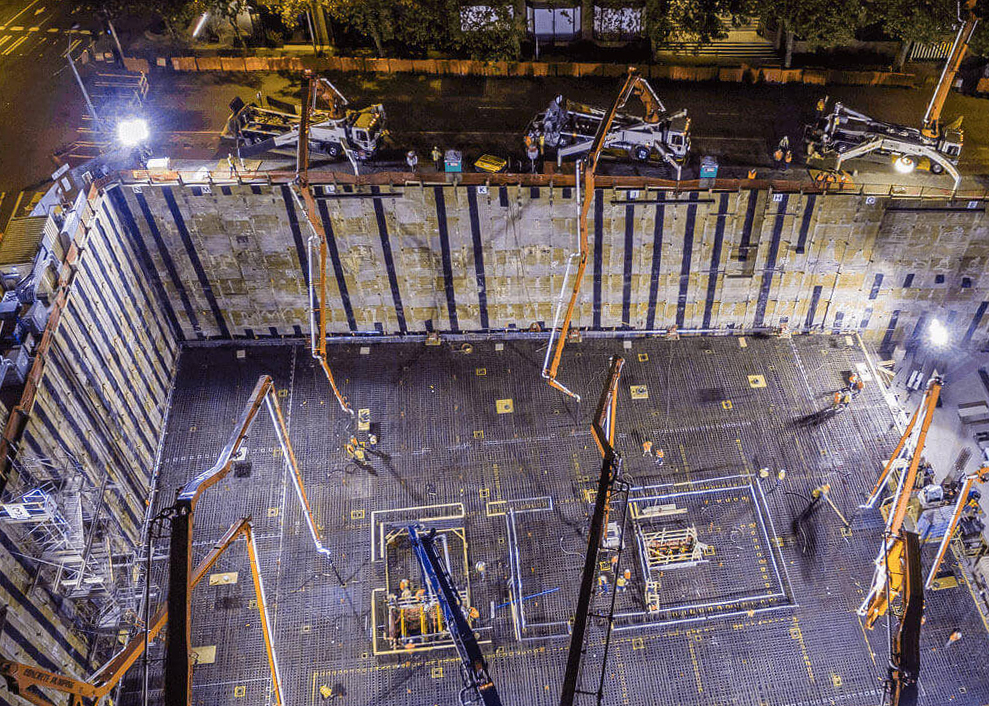

In a recent Washington State Court of Appeals case (Bundage-Bone Concrete Pumping), a concrete pumping business was required to charge and collect tax for its concrete pumping services when it worked as a subcontractor on construction projects.[1] This can be surprising since most subcontracting services can be treated as sales for resale. In this case, the taxpayer was providing “stand alone concrete pumping services.” The Department treated this service as essentially a rental of equipment by the prime contractor and thus not for resale to the building owner.

Background

The Department has a rule addressing these fact patterns with three helpful examples of concrete pumping transactions. In the first, the contractor only provides the pumping equipment and an operator of that equipment. The transaction is deemed subject to sales tax and not a resale transaction. [2] In the second, the contractor provides the pumping equipment and the concrete (i.e. building materials). This example finds that the true object of the transaction is the concrete and therefore the transaction is not subject to sales tax, but instead treated as a resale transaction.[3] Finally, in the third example the contractor provides the pumping equipment but also construction services that include the following:

- Pour and finish the foundation.

- Provide onsite contractors to manage the flow and placement of the concrete.

- Finishing the concrete.

- Assure the finished foundation meets contract specifications. [4]

In this example, the services are not subject to retail sales tax as they clearly provide construction services that can be resold.

Next Steps

Prime contractors and subcontractors engaging in concrete pumping transactions should make sure they understand the nature of the services and how the Department will treat their transactions. If the transaction is treated as rental of equipment, it will be subject to sales tax and not eligible for resale treatment (retailing B&O will also be applicable). The use of a resale permit in that fact pattern could result in a 50% penalty for “misuse of a resale permit.” If it is treated as a construction service or the sale of construction materials, it can get resale treatment (wholesaling B&O will be applicable).

At KOM, we serve many clients in real estate and construction and can help manage risks and opportunities as industry conditions and rulings change.

Contact

Mike Roben, Caleb Allen, John Katsandres, or Michael Brown at KOM Consulting for more information.

[1] Bundage-Bone Concrete v. State of Washington, Department of Revenue, No. 58528-6 II (2/27/2024)